In January 2016 I looked back at the first 16 months of growing BuzzSumo. I thought now, 16 months later, it was probably time to provide a further update on our progress and my reflections on running a bootstrapped SaaS business.

I want to use this opportunity to challenge what I call the Unicorn orthodoxy. I have seen far too many people damaged by the stresses and strains of trying to be a unicorn. I want to set out the case for being a bootstrapped donkey and examine the pros and cons.

Unicorns and donkeys

When you launch a SaaS business, if you are a sad person like me, you will devour articles on growing a SaaS business from pricing to marketing to strategy. Such reading can be helpful as it helps you reflect on your own business. However, in my experience much of the advice is based on what I call the unicorn orthodoxy.

The unicorn orthodoxy is focused on growth and scalability rather than profitability, particularly in the early years. A recent Saastr article for example pointed out that VCs are not interested in companies with less than $10m annual revenues who are not doubling every year. The implication being that unless you are doubling every year you are a donkey rather than a unicorn.

Doubling each year typically means you lose money in the short term as you have to invest very heavily to achieve such growth. This approach requires VC or other sources of funding, to support the company through the loss making early years, typically in the form of seed rounds to series A and B funding rounds.

The aim of this approach is to create a unicorn, not necessarily a billion dollar company, but a dominant market player with the aim of floating the company on the market or selling it.

This high growth approach is rational, particularly for VCs but the downside is that it creates a highly pressurised work environment for those working in the business. You need to hit growth targets, often very unrealistic targets, and being in a loss making business is very stressful as you are burning cash or running out of runway as a VC might say. The consequences can be felt in very human and personal terms.

It is also not uncommon for aspiring unicorns to overstaff in the expectation of hitting unrealistic growth targets and then make redundancies if the growth doesn’t occur and they pivot or look at other options.

Stretch targets can also have the unintended consequence of making successful growing businesses feel depressed and unsuccessful if they miss these targets, and cause high levels of personal stress for staff and their families.

Blinded by Unicorns

I took the title for this section from one of the discarded titles for Rand Fishkin’s upcoming book. This resonated with me because Unicorns by their nature are outliers. It is very hard to draw lessons from outliers. However, sales of books on celebrity unicorns such as Uber, Apple, Snap and Facebook all do very well as people are desperately seeking to understand their secrets.

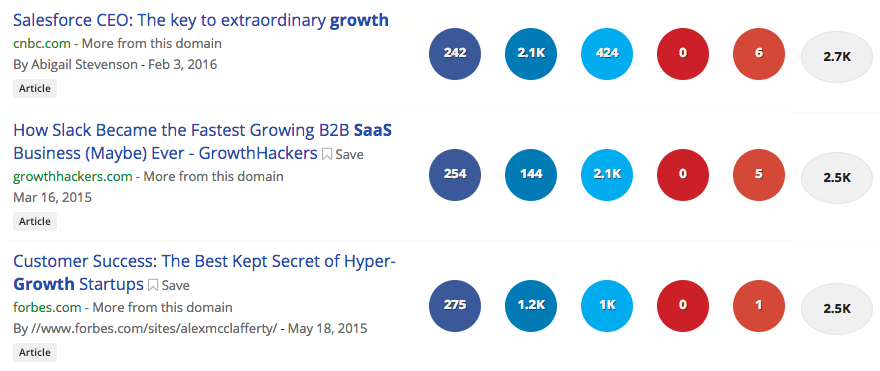

Some of the most shared content in the business world is about these celebrity unicorns. If you want to write a well shared post on Inc or your own blog, create an article along the lines of Five Key Lessons From Uber. Below are some example articles taken from BuzzSumo, along with their social shares.

However, not everyone can be a unicorn anymore than we can all be in the top quartile of company performers or even an above average performer. There is a danger that every SaaS company feels they have to be a high growth unicorn.

Most Aspiring Unicorns Die

Investors are realistic and they expect a high percentage of companies to fail, hence they spread their risk. Dave McClure of 500 StartUps argues that VCs investing in early stage startups should have a portfolio of at least 100 to 200 companies. The reason is simple. In his view only 1-2% of companies become unicorns. Matt Lerner, a partner at 500 Startups, has recently said that 50-80% of startups will fail, despite VC support or being in a program such as 500 Startups. Hence, the need for VCs to invest in a large portfolio of companies to spread their risk and increase their chances of finding a unicorn.

This makes sense for an investor but the management team of a company are all in and committed to their startup. Not for them the luxury of a portfolio that spreads the risk. Their jobs, mortgages and family finances depend on the success of the business. This can create a high degree of stress and anxiety.

This is not to say there are no stresses in building a bootstrapped business. In the early days the owners take all of the financial risk but they can adopt strategies to get to profitability quickly by controlling costs.

The BuzzSumo Donkey

At BuzzSumo we are not a unicorn. We didn’t raise, and are not looking to raise, external funding. We bootstrapped our growth and development, I put in some seed capital along with Stephen Walsh and along with Henley and James we put in time and effort to get things off the ground. Our approach was to quickly build a profitable and cash positive business that would allow us to reinvest and grow organically.

This was also partly about being our own boss and not having to report to anyone but also based on avoiding unicorn burnout and stress. To be clear we work hard but we set our own targets. And they’re realistic targets.

We have no illusions about turning BuzzSumo into a Unicorn. BuzzSumo will never be a billion dollar business. This does not mean we are not successful, just that we have different objectives and ambitions. We are a donkey and proud of it.

So far we have a built a profitable business which allows us to reinvest, pay ourselves from profits, and grow the business steadily. However, we are a relatively small business. Our annual revenue run rate is only $5m currently. Our growth has been solid but not spectacular, we are not doubling our revenues each year but this year we may do 40%.

Maintaining growth is hard as a donkey

In your first year, your monthly MRR growth rates look great as you are starting from a low base. The same is true of year two. However, as your revenues increase it becomes increasingly hard to maintain the same growth rates as this means consistently adding higher and higher levels of revenue each month.

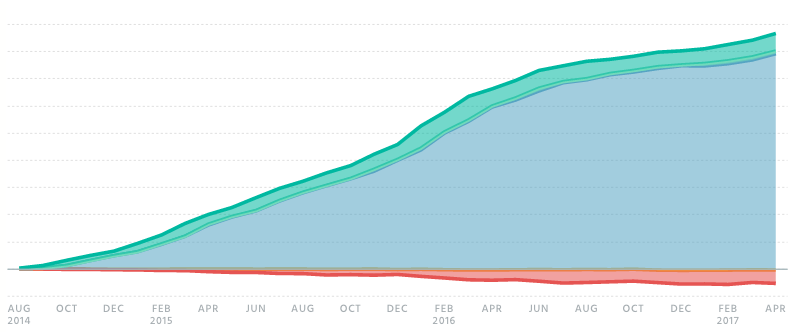

For many SaaS businesses you get an ‘S” shape curve where your MRR growth starts up steeply and then begins to flatten out. You can see this in our monthly MRR from subscriptions over the last 32 months, as shown below.

Blue is existing customers, green new customers and red, the dreaded churn. We are a research tool and we do get people subscribe to undertake projects and then leave. We also have some customers where we are not a good fit for their needs.

My advice is don’t panic if growth slows this is a natural part of the process, particularly if you are investing little in sales and marketing. Better questions to focus on are:

- Are you retaining customers and controlling churn – do you have product fit?

- Are you generating a profit? – Call me old fashioned but as a general rule I don’t think you have a business until you are generating profits. Ok, I know Jeff Bezos might disagree.

Growth is hard work

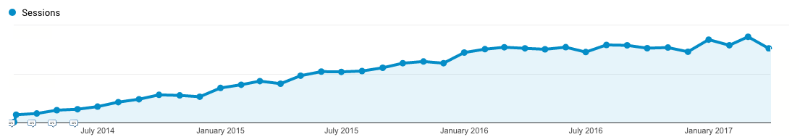

In my experience there are few overnight successes. Most businesses grow on the back of consistent hard work. The same is true of your web traffic. Below is our web traffic since launch. There is no sudden spike, just a slow upward trend over time. Building an audience takes time and commitment.

Ramping up sales and marketing

Logic suggests that once you have a good product fit, and happy paying customers, you should ramp up your sales and marketing investment. This is particularly so if the cost of your customer acquisition is less than the lifetime value of each customer. The unicorn model is designed to accelerate this process, with a focus on sales and marketing investment to drive growth rather than profitability.

As a bootstrapped donkey, focused on profitability, you will have to accept lower growth as you will simply have less cash to invest in sales and marketing.

Our approach was to adopt a simple ‘try and buy’ low touch sales model. In essence users get a free trial of the product and can then buy at the end of the period or fall back to the freemium version. In our model there is very little human intervention, which means a low cost of sale which helps our profitability but arguably at the cost of a lower conversion rate.

We have been particularly slow at BuzzSumo to invest in sales and marketing, we have had no sales staff until this month, and this has probably led our growth rate to flatten more than it needed to. We were fortunate that our self-serve, low touch approach generated reasonable growth each year. Thus we felt no immediate pressure to invest in sales and marketing.

We have probably missed an opportunity to increase our conversion rate and our growth. We set very modest growth targets, for example just 16% this year. This allows us to manage our cash flow and feel good about overachieving our targets but it doesn’t put pressure on us to invest in sales. In a VC backed company it would have been a very different story. We would be under external pressure to grow faster, hire more sales people, and burn through money even if it meant being unprofitable. We have chosen to have complete control rather than the external funding approach.

Forecasts are worthless, be flexible

Ok, this may be a little controversial but don’t take my word for it. NY Fed research recently found that “small business expectations are mostly worthless”. They say people who risk growing a business, when so many fail, are “prone to unreasonable levels of optimism.” This leads to small businesses typically underperforming against expectations. In a VC backed company it is arguable that targets are stretched not just by owner optimism but by the desire of investors to push the management team.

I think there is a collective collusion about the ability of companies to forecast revenues, particularly growth companies. It is like the emperor’s new clothes, everyone colludes and admires the fine detail of a company’s financial forecasts and their growth plan. The reality is none of us know the future.

Mike Tyson may not have been a financial forecaster but he was onto something when he said “everyone has a plan until they get punched in the face”. Plans are great until they come up against reality. What matters more I think is the ability to be flexible and minimise the downside risk. Often aspiring unicorns do the reverse and double down on their bet, spend more on sales and marketing, and increase their losses. It is high risk, which VCs mitigate by investing in many companies.

As I mentioned, at BuzzSumo we set minimal growth targets rather than stretch targets. We have no innate need to hit particular growth targets and we also find cash management and planning easier if we adopt more conservative expectations. We have obligations to our staff and do not want to recruit heavily in anticipation of growth that doesn’t materialise and then have to make redundancies. We also don’t want to feel stressed and unsuccessful because we ‘only’ grow by 20% and not 100%.

Reinvesting profits

It is ok not to reinvest all your profits in growth. Yes, it may mean you accept lower growth over time but there are other considerations. Your team may have financial commitments from buying homes to seeing their kids through college.

It would be anathema to many VCs but allowing the team to take some cash off the table is about balance and rewarding the initial risks and hours of work.

We pay a regular dividend at BuzzSumo. We may be sacrificing higher growth over the longer term. However, no one knows what the future will bring, maybe our business model will be fundamentally disrupted by economic or technology changes. Maybe a bird in the hand really is worth two in the bush as the old saying goes.

Focus on improving core product

I believe our success has come from helping people do a few tasks quickly and easily.

We have added features such as outreach lists, the audience builder and Facebook Analyzer but most users still focus on our core features such as most shared content, influencer searches, trending content and monitoring of brand mentions in content.

In retrospect I think we could have added less new features and focused more on improving the core features. Such improvements are less immediately noticeable to clients for example we have been improving our search results at BuzzSumo but to clients they do not see something as obvious as a new feature tab.

Don’t create additional brands

It is hard work to create a brand and it takes time.

We have developed a couple of separate free products such as Bloomberry, which will list real questions asked on the internet about any topic.

Separate from BuzzSumo, I have also been involved in developing Anders Pink. A news app for individuals and teams. This is a personal passion project as I believe there is so much content we all need a briefing every morning. The app allows you to create briefings on any topic and we will deliver the latest relevant articles that you can share and discuss with colleagues.

My advice, however, would be for bootstrapped businesses to focus on a single brand. Building brands is just such hard work and you will have limited time and cash to develop multiple brands. Sometimes though it is fun to develop something which is not core to your business.

The downsides of being a donkey

There are downsides to being a donkey. The lack of VC pressures and stretch targets can lead to a lack of focus. Lack of money can also mean missed opportunities to build a large business.

We are guilty of exploring new ideas because they intrigue us rather than because they will contribute to company growth. I admit we get bored easily and we like to explore new ideas. The ability to do this is both a good thing and a less good thing.

We take and invest profits based on a balance of our personal and business needs. Unicorn investors will be appalled that having achieved a product market fit we don’t reinvest all of our profits in growing the business. They will be further appalled that until this month we have employed no sales or marketing staff. But there’s a lot to be said for generating a profit every month.

The tax structure in the US and the UK favours capital gains over income. You pay much higher tax on salary and dividends than on a capital receipt for selling your business. Thus donkeys are taxed far more heavily than unicorns. Investors can also write off losses in failed unicorns against profits elsewhere. However, I am not Swedish but I don’t mind paying a fair level of tax. I live in the UK and I am proud of the tax we pay to have a free at the point of need health service. This is not to say there are not many ways we can improve it or spend our tax more efficiently.

The rise of the donkeys?

I may just be me but I am beginning to see more articles critical of the unicorn orthodoxy. Here is a recent example from the team at Basecamp, who have long advocated a different approach.

https://m.signalvnoise.com/exponential-growth-devours-and-corrupts-c5562fbf131

Maybe we will see a lot more donkeys and happier people in bootstrapped companies in the future.

Categories

Content MarketingCategories

Content MarketingThe Monthly Buzz⚡

Subscribe to BuzzSumo's monthly newsletter to:

Stay up-to-date with the best of the best in content marketing 📝

Get data-informed content, tips and tidbits insights first 👩🏻💻

Read top shared content by top marketing geeks 🤓

Try

Enter any topic, term or url to search to see BuzzSumo in action. It’s free!

100% free. No credit card required.