Published January 29th 2021

Social Media & Stock Markets: How Much Digital Engagement Does It Take To Raise $1bn?

We take a look at Robinhood's ascent and the role of social media in mobilizing a shakedown of the world's most powerful financial institutions.

Robinhood, a free-trading app that lets investors trade stocks without paying fees (otherwise known as Wall Street’s biggest nightmare), has just managed to raise $1bn from investors. Not bad for a week’s work.

It all started with a subreddit, a retro yet floundering video game store – GameStop – and a common feeling of antipathy towards some hedge funds.

The app was ultimately weaponized by a crowd of amateur investors to trap hedge funds in a “short squeeze” costing them billions.

Since this eye watering sum came about purely as a result of their users’ social media activism, we wanted to know: just how much digital engagement do you need to generate to be in with a chance of rustling up $1bn?

Let’s cut to the chase. We’ve been using BuzzSumo and Brandwatch to look at:

- Social conversation

- Headline shares / engagement

- Headlines published

- Article mentions

Of the keyword ‘Robinhood’ from 1st January 2021 – 29th January 2021, when news broke that Robinhood had managed to raise $1bn.

Note that ‘Headline’ data here includes all content (8bn+) tracked in BuzzSumo from across the web; including blogs, articles, social media forums and even YouTube videos.

Uplift in Digital Engagement

| Metric | Percentage uplift | Total |

|---|---|---|

| Social conversation | 14,000% | 2.7m mentions |

| Headline engagement | 60,000% | 3.0m shares |

| Headlines published | 1,300% | 4.9k headlines |

| Article mentions | 1,600% | 16k mentions |

Methodology for percentage uplift:

- We calculated an average of each of the above metrics for the term ‘Robinhood’ from Jan 1st – Jan 26th, as this timeframe presented fairly stable / standard engagement for Robinhood.

- We then calculated and average of each of the above metrics for the term ‘Robinhood’ from Jan 27th – Jan 29th, the peak of interest – shortly after Elon Musk got involved on Twitter, at the point Robinhood was pressured to restrict trading for GameStop shares, and up until the point of the $1bn investment.

- We then calculated the percentage uplift between the two, to show how much digital engagement growth you would theoretically need to achieve across those metrics to raise $1bn.

So, in theory you would need to boost all social discussion around your brand by a full 14,000%, and generate 60,000% more shares of articles mentioning your brand 😅

We know this is an oversimplified way of looking at things, and that you’d need a heck of a lot more than digital engagement alone to get your hands on $1bn, but we thought it would be interesting to benchmark this insight all the same!

Total Digital Engagement

| Percentage uplift in engagement | Total engagement |

|---|---|

| 2,600% | 5.7m |

Overall, it seems that to raise that coveted $1bn, you need to somehow generate 2,600% uplift* in engagement in both content and conversation around your brand, or a grand total of 5.7m mentions.

Sounds achievable…

😐

Interestingly, GameStop shares – ie. the shares that led to Robinhood’s $1bn investment – increased almost synchronously with digital engagement – rising by 2,400% (from $US19 to $US483 at its peak), and even more interestingly 5.7m is also the figure of the members making up the subreddit r/wallstreetbets.

Is the stock market and social media more closely linked than we first thought?

* This is not an average of the larger percentages in the earlier table (we know averaging percentages is a no no!), but rather the percentage uplift between all total engagements 1st Jan – 26th Jan, and all total engagements 27th Jan – 29th Jan.

Could the Wall Street debacle and Robinhood’s ascent have been predicted?

If you follow the social trend line above, mentions around Robinhood appeared seemingly out of the blue.

While Robinhood might have seen this extreme growth coming, based on the sheer volume of stocks being purchased via its own app, it’s safe to say that the hedgefunds that lost billions did not.

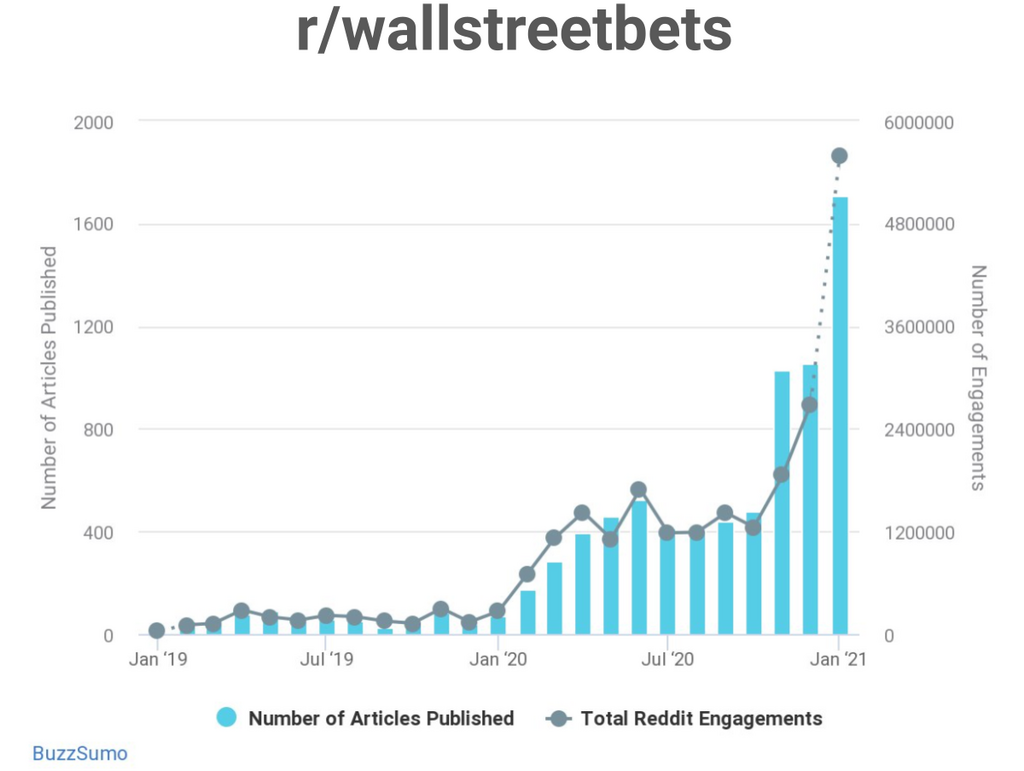

But when you study social trends, the data shows that something was brewing on the subreddit /r/wallstreetbets as far back as January 2020– so, could this all have been foreseen?

Well, put it like this, I wish I’d been monitoring r/wallstreetbets a long time ago – my bank account would be thanking me profusely right now!

Social data is real time information, it’s the birthplace of viral consumer trends and, most importantly, it can be monitored with a simple alert.

At the end of the day, news becomes conversation and conversation becomes news.

Overlooking social trends can mean you lose out on big opportunities, or end up paying a hefty price.

Robinhood’s competitors (ie. no fee, free-trading apps) would do well to set up future social and web alerts on the inventory of their own platforms.

This might help them spot Reddit’s next (stock based) weapon of choice in it’s David vs. Goliath war against hedge funds, and ultimately replicate Robinhood’s success.

In fact, they should do so sooner rather than later, if this article from The Verge is anything to go by…

After buy ban, GameStop hypebeasts are looking for a Robinhood alternative

If you want to start matching content with conversation analysis, why not get a 30 day trial of BuzzSumo or book your Brandwatch demo here.

Categories

Social Media MarketingThe Monthly Buzz⚡

Subscribe to BuzzSumo's monthly newsletter to:

Stay up-to-date with the best of the best in content marketing 📝

Get data-informed content, tips and tidbits insights first 👩🏻💻

Read top shared content by top marketing geeks 🤓

Try

Enter any topic, term or url to search to see BuzzSumo in action. It’s free!

100% free. No credit card required.